Everything about Best Broker For Forex Trading

Table of ContentsThe Ultimate Guide To Best Broker For Forex TradingThe Definitive Guide to Best Broker For Forex TradingThe 6-Minute Rule for Best Broker For Forex TradingSome Known Facts About Best Broker For Forex Trading.Some Known Questions About Best Broker For Forex Trading.

Trading forex involves all at once buying one currency and offering an additional. Money are sold pairs, e.g. the Euro against the US Dollar (EUR/USD). The very first currency in both is called the base money and the second is called the counter or quote currency. So if the EUR/USD is trading at 1.14149, this means that 1 is worth $1.14149.Portfolio supervisors utilize the foreign exchange market to diversify their holdings (Best Broker For Forex Trading). Prior to beginning to trade forex, it is valuable to spend a long time discovering the market and factors such as the risks of utilizing leverage. There are many terrific complimentary sources readily available online to help you with this, such as the education and learning area of this internet site

Foreign exchange brokers based offshore generally have extremely little governing oversight and are much more risky to work with. Several brokers call for extremely low minimum down payments to get started.

It might consist of some standard inquiries about trading forex and CFDs. New foreign exchange investors need to be aware of over night swap fees.

The Best Guide To Best Broker For Forex Trading

Before trading in an online account it is a great idea to establish a strategy and test it in a demo account. Additionally, micro accounts and adaptable whole lot sizes allow new investors to exercise with actual cash while keeping threat to a minimum. Starting a trading journal is a terrific method for new traders as it helps to identify strengths and weaknesses and track progression.

Trading based upon financial information is an example of a basic approach. An investor might be enjoying the US employment report and see it come in even worse than the agreement expected by analysts. They may after that make a decision to get EUR/USD based upon an assumption that the dollar will damage on the unsatisfactory United States information.

Trying to find cost breakouts towards the dominating market fad is an example of a technological trading approach. The London Opening Array Breakout (LORB) is an example of such a method. At the time of the London open, traders using this approach appearance for the price of GBP/USD to burst out over a recent high or below a current low on the per hour graph with the expectation that rate will proceed to pattern in that instructions.

Here investors try to find particular graph patterns that suggest whether price is most likely to turn around or remain to fad in the very same instructions. The Pin Bar is a preferred turnaround pattern. Below, cost gets to a brand-new high (or reduced) and go to website after that turns around to close near where it opened, showing an absence of conviction amongst the bulls (or bears).

A Biased View of Best Broker For Forex Trading

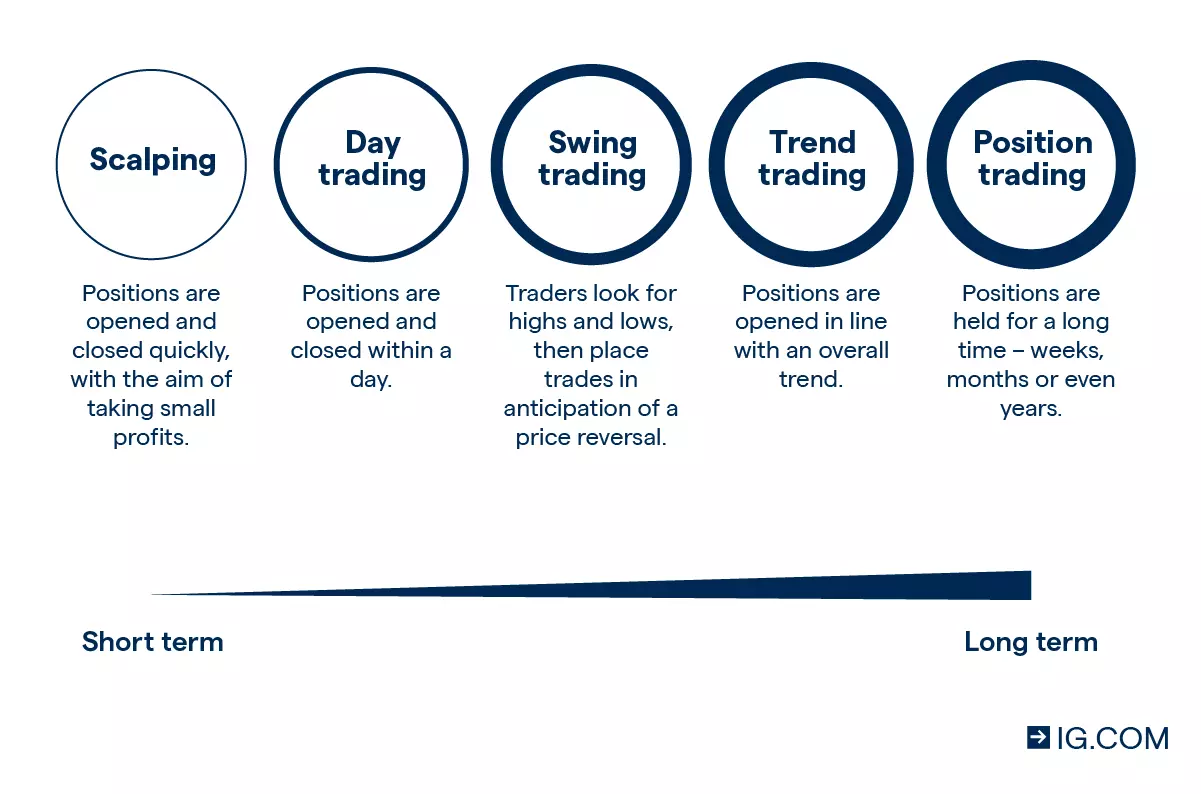

hold market positions for months or also years. Holding such long-term settings in the foreign exchange market has the potential benefits of making money from major cost patterns and additionally being able to make passion from a positive rate of interest price differential. The most preferred chart types in forex trading are Bar Graphes, Candlestick Charts and Line Charts.

resemble Prevent graphes because they show the high, reduced, open, and closing rates for an established amount of time. Candlesticks make it easy for investors to recognize whether the marketplace is bullish or bearish within a given period by coloring the location in between the open and close green or red.

Best Broker For Forex Trading Fundamentals Explained

merely draw the line from one closing cost to the next closing rate. This graph kind makes it simple to see cost fads however provides little insight right into what happened over each period. Forex trading can be profitable, yet the data shared by major brokerage firm firms reveal that the bulk of traders lose money.

It must likewise be highlighted that timing have a peek at this website the market and trying to forecast short-term relocations in the marketplace are exceptionally challenging. Margin is the first capital required to open up and hold a leveraged placement in the market. For instance, a margin demand of 1% equates to available leverage of 1:100.

Best Broker For Forex Trading Fundamentals Explained

The spread is the void in between the bid and offer (likewise recognized as 'ask') rates of a currency pair. This implies that the ideal cost that you can presently get EUR/USD is 1.14133 and the best cost you can presently offer at is 1.14123.

A pipette is one tenth of a pip, usually in the fifth decimal place. Forex trading has vital benefits and disadvantages compared to other markets. Recent developments in the equities market, such as the development of fractional share trading and commission-free trading, have deteriorated several of the advantages of forex.